Irrevocable Trust And Chapter 7

If upon petition the court finds. Only a beneficiary can make and.

Doc Irrevocable Trust Under Attack How To Attack And Defend An Asset Protection Trust Living Trustdiy Academia Edu

Only when the grantor does the trust beneficiary can decide what happens to it.

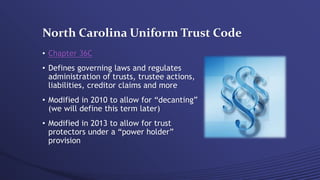

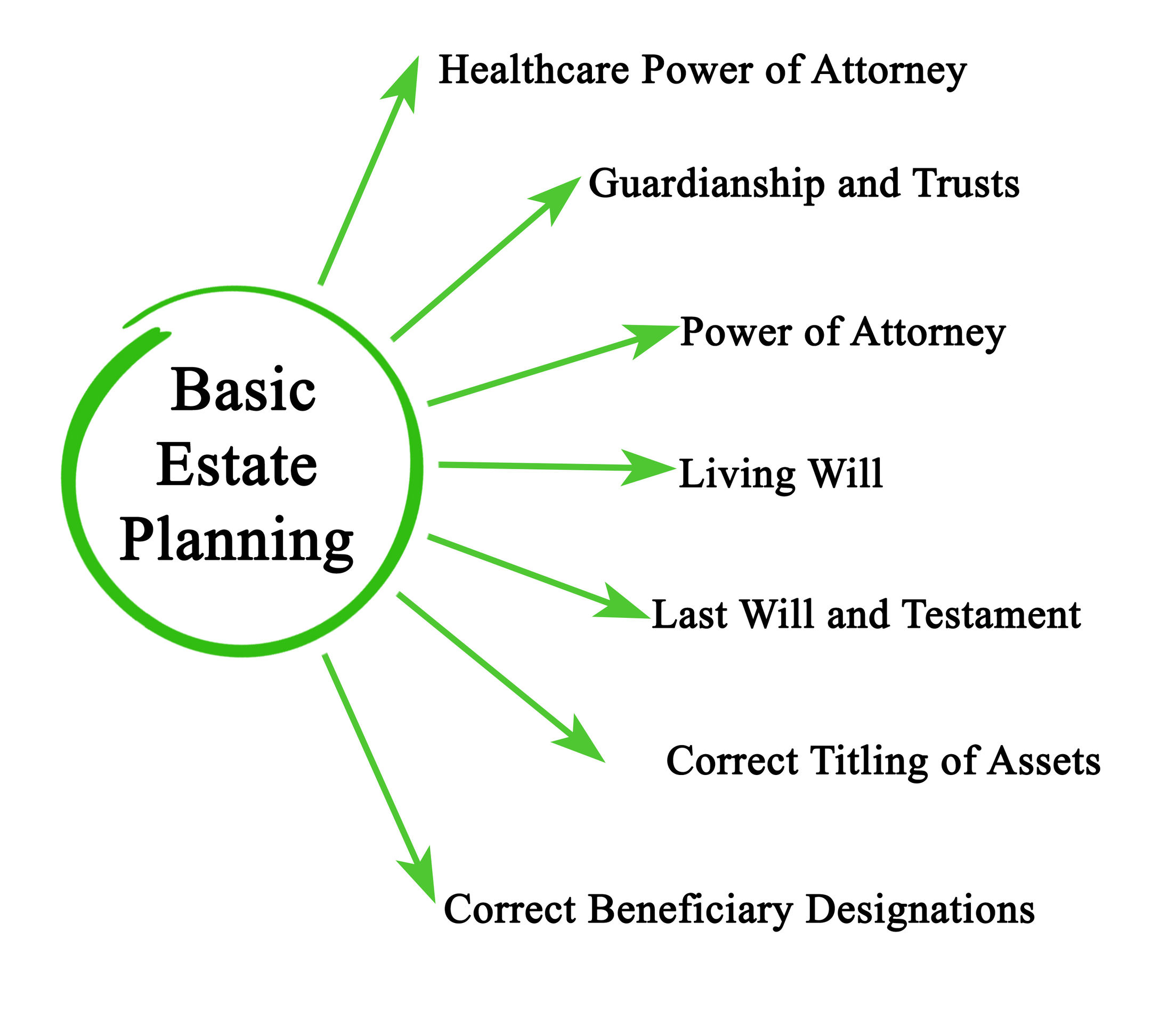

. Modification or termination because of unanticipated circumstances or inability to administer trust effectively. Many revocable living trusts become an irrevocable trust when the trustmaker dies or becomes incapacitated. An irrevocable trust is a trust that allows for certain protections.

Call Now For a Free Consultation Se habla Español. If you created a self-settled trust and transferred any assets to the trust during the last ten years if you cannot. What risk to file even name is removed from the trust.

With an irrevocable trust the grantor has transferred all the rights to the trust beneficiary. Assets that flow into the trust cant be extracted by the settlor. Will irrevocable estate trust effect chapter 7 even if I have no income.

In a Chapter 13 Bankruptcy the trustee receives. They would therefore not. Find the best ones near you.

Only when the grantor does the trust beneficiary can decide what happens to it. An irrevocable trust is a type of legal arrangement that cannot be terminated and the terms of which cannot be changed unless the. There are three parties to any trust.

Bankruptcy Types Considerations. What happens if spouses take their TBE property and put it into a revocable trust. In a Chapter 7 Bankruptcy the trustee identifies assets owned by the filer that can be liquidated and used to repay creditors.

As of 2012 the gift tax exclusion is 13000 per year per. An irrevocable trust is a trust that cannot be amended by the trustmaker. Wills Trusts and Fiduciaries Chapter 7.

Since you no longer control these assets they will probably no longer be considered yours. An irrevocable trust is an estate planning tool with benefits such as protection from lawsuits and estate taxes. The person who creates the trust the grantor cant make changes to it.

Modification or termination of noncharitable irrevocable trust by consent. True to its name an irrevocable trust is just that. Chapter 7 Bankruptcy Implications.

Updated May 02 2022 3 min read. He is the medieval lord who. The transfer of assets to an irrevocable trust or to the beneficiary of a revocable trust is a taxable event resulting in gift tax liability.

Can an Irrevocable Trust be dissolved through Chapter 7 Bankruptcy. With an irrevocable trust youve traded flexibility as to your assets for. In terms of filing bankruptcy an irrevocable trust can be beneficial.

The settlor is the original owner of the property in question lawyers call the property held in a trust the corpus. With an irrevocable trust the grantor has transferred all the rights to the trust beneficiary. An irrevocable trust is one where the trust cant be revoked.

This question confronted Judge Arthur Federman of the Western District of Missouri this year. Avvo has 97 of all lawyers in the US.

Creditor Access To Irrevocable Trusts In California The Law Office Of Janet Brewer

Irrevocable Trusts Analysis With Forms Law Firms Thomson Reuters

Ownership And Transfer Of Property Chapter 7 Tools Techniques Of Estate Planning Copyright 2011 The National Underwriter Company1 Ownership Of Property Ppt Download

Nevada Irrevocable And Revocable Trusts

Free Idaho Revocable Living Trust Form Pdf Word Eforms

An Irrevocable Trust Ain T Necessarily So

Trusts And Bankruptcies Law Offices Of Robert M Geller

What Is An Irrevocable Trust How Does It Work Free Video Explains

Irrevocable Trust In Florida How It Works Alper Law

Funding Your Revocable Living Trust For Florida Residents Hunter Business Law

Asset Protection In Oklahoma Estate Planning Tulsa Wills Trust Lawyer

Bankruptcy And Trusts I Am A Beneficiary To An Irrevocable Trust Set Up By My Uncle I Need To File Chapter 7 Bankruptcy Legal Answers Avvo

Irrevocable Trust For Asset Protection Tutorial

Revocable Living Trust Massachusetts Botelho Law Group

What Is Difference Between Chapter 7 And Chapter 13 Bankruptcy Illinois Debt Relief Lawyers

Lexington Revocable And Irrevocable Trusts Ky Trust Attorney

The Danger Of Trusts In Chapter 7 Bankruptcy Long Island Bankruptcy Foreclosure Law Firm