32+ can you claim mortgage interest

Web Say you rent your basement to a tenant for the entire year. Web When entering the 1098 only enter the amount that you actually paid not the full amount.

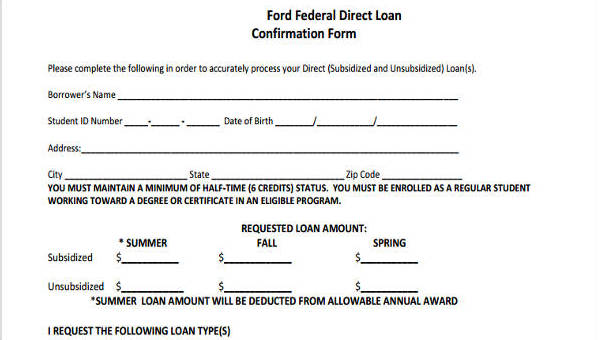

Free 8 Loan Confirmation Forms In Pdf

Web Mortgage interest.

. For taxpayers who use. Web In some cases the amount charged for late payments is also limited by state law. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

In this case you must adjust your deduction to be equivalent to the portion of your home thats rented. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Find A Lender That Offers Great Service.

Quit claim deed is the simplest cleanest way to transfer or divide a property interest. Web If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro-rated portion of that lump sum is deductible in the tax year it was paid. After the interest-only period.

HELOCs are no longer eligible for the. Web Then yes you can enter the interest paid on the mortgage. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Like other mortgages youll pay this loan off with regular monthly payments that include interest. Web As the name suggests a 40-year mortgage is a home loan with a term of 40 years. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

But for loans taken out from. The 1098 is in someone elses name not a seller-financed loan but you pay some or all. With a fixed-rate loan your interest rate will never change.

On most types of loans the late charge is only applied to principal and interest. Lets say you paid 10000 in mortgage interest and are. Web IRS Form 8396.

Ad Transfer property to family or to a trust without warranties. Web While interest on a mortgage can be a significant expense and finding ways to lower your rate can save a lot of money dont forget about the other expenses that can come with. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Web An interest-only mortgage requires payments just of the interest the cost of borrowing money during the first years of the loan. Mortgage Interest Credit is used by homeowners to claim the mortgage interest credit but you can only claim it if you receive a mortgage credit. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. If you hold this loan to full term it will take you 480 monthly payments to pay it off. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns. Compare More Than Just Rates. Web You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately.

Web Schedule A of IRS tax form 1040 guides you step by step through the calculations youll need to determine how much mortgage interest you can deduct. However higher limitations 1. If you are on the deed with someone else you should divide the amounts you paid and report them.

Schedule A accompanies Form 1040 or 1040-SR. Web Home mortgage interest.

Soundcore By Anker Soundcore Sport X10 Bluetooth 5 2 Headphones For Sports Rotating Ear Hooks Deep Bass Ipx7 Water Protection Sweatproof 32 Hours Battery Amazon De Electronics Photo

Easton Hill On Linkedin Money Inflation Millionaire 17 Comments

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Escrow Account Information We All Can Benefit From Knowing

16828 E 32nd Ave Greenacres Wa 99016 Realtor Com

Oct 13 At Home In Berks By Christian D Malesic Mba Cae Cmp Iom Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Starting A Business As An International Student

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction

Antelope Orion 32 Gen3 32 Channels Funky Junk Portugal

Don T Be Overwhelmed With Paperwork Valley West Mortgage

16828 E 32nd Ave Greenacres Wa 99016 Realtor Com

Open Esds

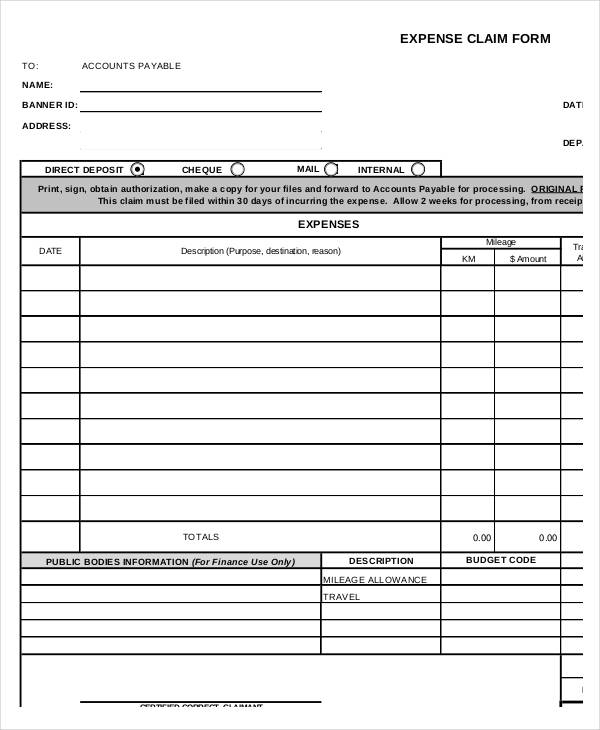

Free 32 Claim Form Templates In Pdf Excel Ms Word

Economist S View Real Median Household Income In The Us

How You Can Create A Passive Full Time Income In 90 Days Or Less By